How Card Processing Fees Work

Processing fees paid by business owners

The acquirer is responsible for collecting all the fees paid by the business owner. Acquirers employ a variety of pricing strategies. Common pricing strategies (which are generally self-explanatory) include; Bundled, Tiered, Interchange Plus, Interchange Optimization, and Flat Rate. Some methodologies are more transparent to the merchant than others.

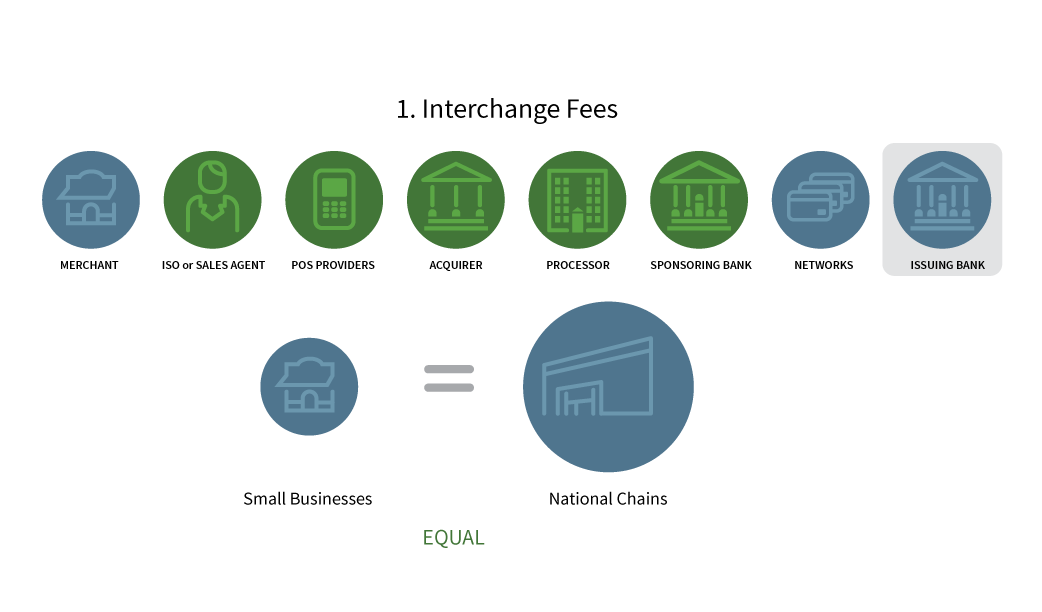

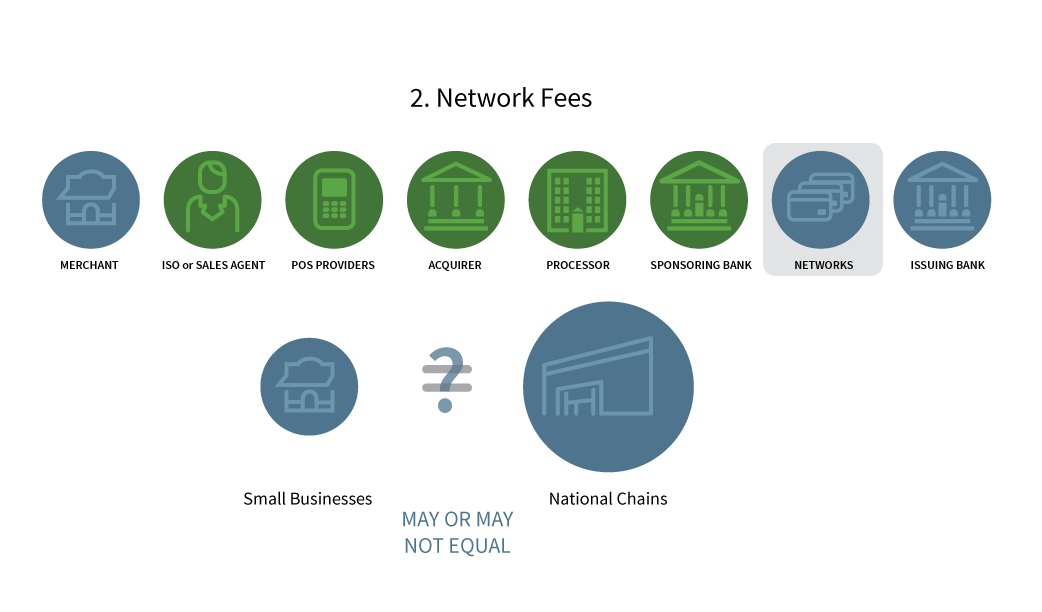

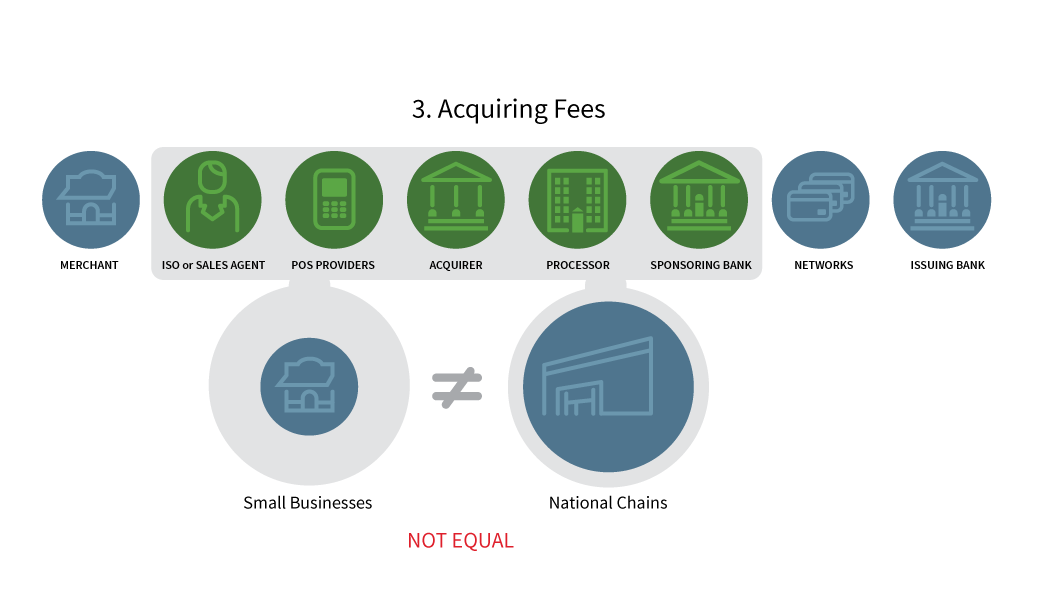

Regardless of the contract structure or the level of transparency, there are three types of fees that represent the total cost of card acceptance paid by business owners.

How Card Processing Fees Work

How Card Processing Fees Work

Processing fees paid by business owners

The acquirer is responsible for collecting all the fees paid by the business owner. Acquirers employ a variety of pricing strategies. Common pricing strategies (which are generally self-explanatory) include; Bundled, Tiered, Interchange Plus, Interchange Optimization, and Flat Rate. Some methodologies are more transparent to the merchant than others.

Regardless of the contract structure or the level of transparency, there are three types of fees that represent the total cost of card acceptance paid by business owners.