As of February 2016, 37% of businesses were currently able to accept chip enabled cards; this percentage falls short of the 44% that was estimated to be accepting by February 2016 (Jones, 2016). As of March 31st, the total number of deployed VISA EMV chip cards was 264.9 million cards in the U.S., which is an increase of 86.6% since October 2015 (Woodward, 2016). While some businesses have been slower to adopt EMV terminals than expected, it is estimated there will be an increase in adoption as there has been a growing number of chargebacks. These chargebacks are shedding light on the importance of upgrading POS systems and terminals more quickly.

According to Jeff Stocki, vice president of operations at Troy, Michigan based North American Bancard, “chargebacks for card-present transactions increased 50% following the October 1st 2015 EMV liability shift while overall chargeback volume across the more than 250,000 merchants in NAB’s portfolio increased 15% (Woodward, 2016).” His suspicion for the increase is that issuers are using the EMV reason code when processing chargebacks. There also is the realization that a merchant who cannot process EMV chip cards is liable for fraud now. These chargebacks have not only been occurring with large ticket items and in large retailers like the Kroger Co (who had a 23 basis-point increase in its fourth quarter operating costs due to related EMV chargebacks (Transactions, 2016)), but this is affecting small-ticket transactions and small and medium businesses. Due in part to the increase in chargebacks, approximately 54% of small and micro businesses that didn’t accept EMV cards in February plan to be EMV-enabled within a year (Daly, 2016).

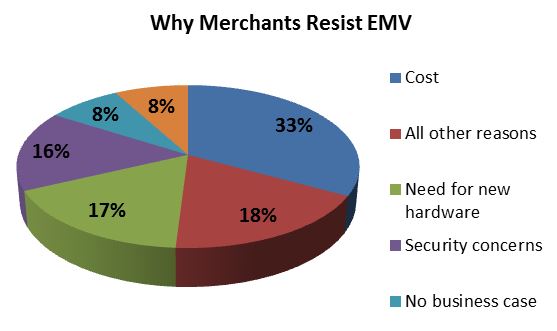

While it may seem like a simple decision to upgrade to EMV equipment, this decision does not come easily for many businesses. In a survey conducted by Javelin Strategy & Research cost played the biggest role in businesses resisting the transition to EMV.

Source: Javelin Strategy & Research (Daly, 2016)

These costs as well as unexpected chargebacks have already led to a lawsuit. Max Milam, chief executive of B&R Supermarket Inc. is suing all the major card networks and eight of the 10 largest bank issuers because of the flood of chargebacks totaling more than $10,000 after the EMV liability shift. Max spent $20,000 on 33 new EMV-capable terminals before the liability shift, but the long EMV queues to get EMV equipment certified by the processors has prevented them from using the EMV function. During this time, Max has incurred 88 chargebacks totaling $10,000 (Stewart, 2016). Read more about the story here.

While it is difficult to avoid the cost of new equipment, please make sure you buy or rent (month to month) your new equipment, never lease a terminal. In addition, some things you can do to prevent chargebacks if you are not using an EMV device today include:

- Match the last four numbers of the credit card

- Request/verify the signature

- Ask for customer’s ID

- Swipe non-chip cards and insert chip cards (make sure you run the chip cards as chip transaction)

- If a card is declined ask for another form of payment

If you have any questions about your EMV preparedness or if you need EMV equipment, make sure to ask and speak with a trusted adviser like Wimsett & Company.