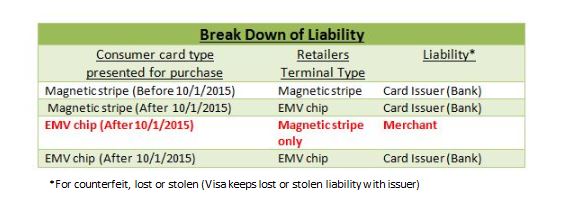

According to Digital Transactions, as of late August 2015 (the last time data was available) only 301,000 of the 8 million card-accepting merchant locations were activated to accept chip card payments. This number is low considering that on October 1st, 2015 the liability for counterfeit fraud switched to the business owner rather than the bank that issued the card. Please see chart below for more information on how this liability shift works.

Many people would assume more than 3.76% of businesses would be accepting EMV; however, in other EMV countries it took about 3 years after the liability shift before 90% of payment card transactions were accepted. The reason for slow adaption of EMV cards is due to both card issuers and merchants. Only 20% of the 720 million Visa cards in the U.S. have been upgraded to EMV by the issuing banks (Daly, 2015). This number will continue to increase over the next few years as most card manufacturers are experiencing dramatic increases in their EMV chip card orders.

Another reason for slow adaption by the issuers and merchants is the cost associated with switching to EMV acceptance. “The new POS terminals for merchants and cards for consumers will collectively cost at least $6.8 billion,” with issuers paying approximately 62% and merchants 38% (Daly, 2015). In addition to high costs, merchants are concerned with what to do about EMV with the holiday shopping season coming soon, minor software glitches some are experiencing, and the speed with dipping (slowing down transactions). These are relevant concerns and with 92% of counterfeit fraud losses concentrated among some 500 merchants, businesses are wondering is it completely necessary for them to shift right away before the holidays (Stewart, 2015).

As far as the necessity of EMV POS systems and terminals in the future, with the constant advancements in technology and hacker capabilities to capture information and perform counterfeit transactions, businesses should ultimately upgrade their equipment with the latest and securest software and technology. This equipment should include a dual-interface for accepting not only EMV chip cards, but NFC (mobile acceptance) technology, as it is presumed mobile payments will be increasingly utilized in the future. That being said, businesses should do research into the true cost of POS or terminal equipment and never lease a terminal. With this EMV change, there is an opportunity for credit card processing companies and POS equipment sellers to profit by overcharging businesses owners.

Bibliography

Daly, J. (2015). The Big Bang It Ain’t. Digital Transactions, 20-26.

Stewart, J. (2015, 10 16). With EMV’s Liability Shift in the Past, How Will Merchants React to First Statements? Retrieved 10 19, 2015, from Digital Transactions: http://www.digitaltransactions.net/news/story/With-EMV_s-Liability-Shift-in-the-Past_-How-Will-Merchants-React-to-First-Statements_